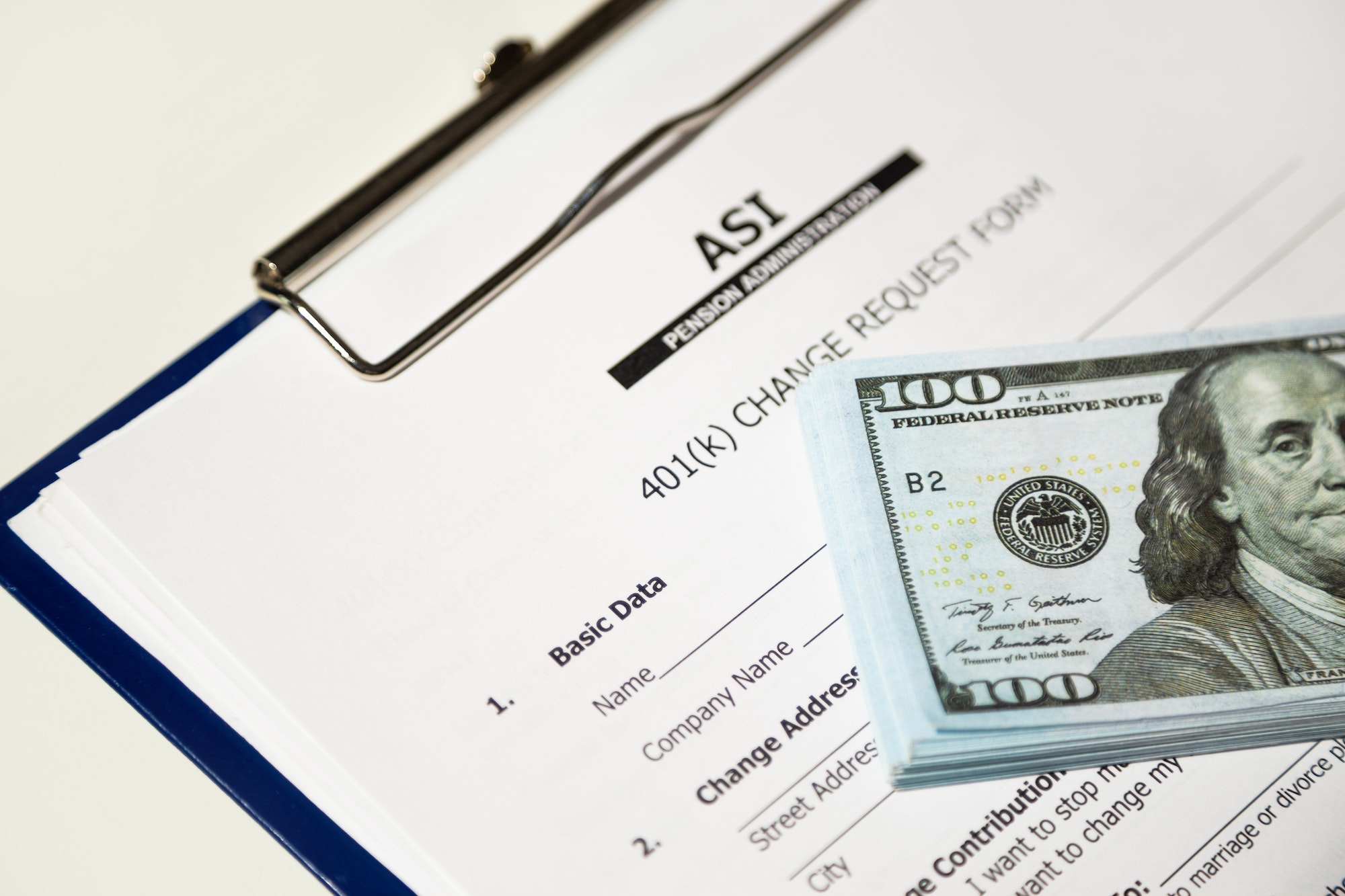

The Employee Misclassification Protection Act of 2010 (EMPA), amends the federal Fair Labor Standards Act (FLSA) to Increase government enforcement against employee misclassification practices by employers of all sizes, to curtail and penalize worker misclassification.

EMPA sets strict notice and record-keeping requirements on all employers, with costly penalties for non-compliance (up to $5000 per worker). It requires all states to develop and enforce their own employee misclassification enforcement programs through audits and other methods.

On April 22, 2010, the Employee Misclassification Prevention Act (S. 3254, H.R. 5107) was introduced in both the House and the Senate. In addition to imposing civil penalties for misclassification and directing the DOL and state unemployment insurance agencies to perform misclassification audits, this bill would require employers to keep records concerning their classification of individuals as independent contractors and notify those individuals of their classification, along with information on what to do if they feel they have been incorrectly classified. Additional pending legislation, such as the Taxpayer Responsibility, Accountability, and Consistency Act of 2009 (S.2882), which proposes amending the tax code to make classifying workers as independent contractors more arduous, also seeks to address this issue.

Editor’s Note: This is one of several bills now pending in Congress to increase federal agency enforcement against misclassification of employees as independent contractors. It appears likely that at least one or a combination of these bills will be passed by Congress shortly.