Our nation’s small businesses have been facing unprecedented economic disruption due to the COVID-19 pandemic. On March 27, 2020, President Trump signed into law the CARES Act, which contained emergency relief resources for workers and small businesses.

Paycheck Protection Program (PPP)

The CARES Act established the new $350 billion Paycheck Protection Program (PPP), allocating it to the Small Business Administration (SBA). The PPP is specifically designed to help small businesses sustain their businesses and keep their workforce employed.

Businesses can apply to borrow up to 2.5 times their average monthly payroll costs, up to $10 million. Businesses must maintain their payroll levels for at least eight weeks and spend at least 75% of their loan on payroll which will be fully forgiven. In addition to using loan proceeds for payroll expenses, business owners can use loans for rent, utilities, mortgage payments, and other essential business expenses. Businesses can apply for the program through qualified SBA lenders or download the updated PPP application (PDF format).

Non-English language support:

COVID-19-related materials are provided in 17 different languages.

COVID-19 Economic Injury Disaster Loan (EIDL)

If you are a small business, non-profit organization of any size, or a U.S. agricultural business with 500 or fewer employees that have suffered substantial economic injury as a result of the COVID-19 pandemic, you can apply online for the SBA COVID-19 Economic Injury Disaster Loan (EIDL) or download the application in PDF format. The EIDL is intended for working capital and normal operating expenses such as the continuation of health care benefits, rent, utilities, and fixed debt payments.

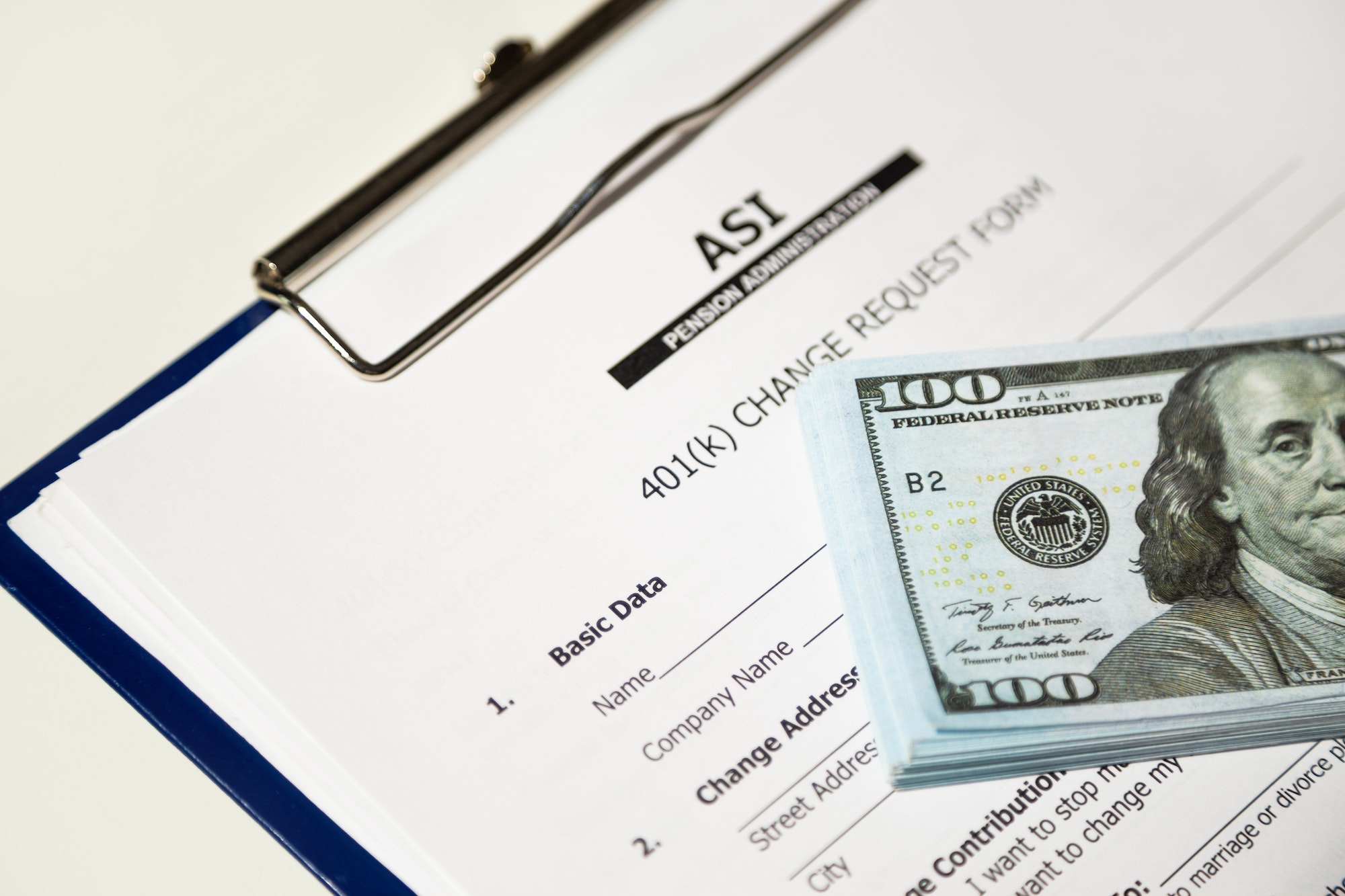

The terms of the EIDL are:

- The length of the loan is for 30 years.

- Interest is 3.75% fixed for businesses, and 2.75% fixed for nonprofits.

- There are no pre-payment penalties or fees.

If you are borrowing $25,000 or more, collateral is required. The SBA uses a general security agreement (UCC), designating business assets as collateral such as machinery and equipment, furniture, fixtures, etc.

SBA Express Bridge Loan Pilot program

The Express Bridge Loan Pilot Program allows businesses who have a business relationship with an SBA Express Lender to quickly access up to $25,000. These loans help you overcome the loss of revenue and can be used as term loans or used to bridge the gap while applying and waiting for a direct EIDL.

The terms of the Express Bridge Loan include:

- Loan amounts up to $25,000

- Fast turnaround

- Repayment in full or in part by proceeds from the EIDL

SBA Debt Relief

The SBA will pay six months of principal, interest, and associated fees that businesses owe for all current 7(a), 504, and microloans. However, this relief package is not available for PPP loans or EIDLs. The details for this assistance are as follows:

- For loans not on deferment, the SBA will begin making payments with the next payment due on the loan and will make six monthly payments.

- For loans currently on deferment, the SBA will begin making payments with the next payment due after the deferment period has ended and will make six monthly payments.

- For loans made after March 27, 2020 and fully disbursed prior to September 27, 2020, the SBA will begin making payments with the first payment due on the loan and will make six monthly payments.

SBA Serviced Disaster Loans

If you have a current SBA Serviced Disaster loan that was in regular servicing status on March 1, 2020, the SBA is providing automatic deferments through December 31, 2020. What does this mean?

- Your interest will continue to accrue on the loan.

- 1201 monthly payments notices will continue to be mailed out which will reflect that the loan is deferred and no payment is due.

- If you prefer to continue making payments during the deferment period, the SBA will apply those payments normally as if there were no deferments.

- Once the deferment period has ended, you will be required to resume making your regular principal and interest payments.